CORMAC CREAVEN LETTER TO KISD ABOUT LINEBARGER:

This letter pretty much says it all about Linebarger.

It would be nice if Mr. Creaven would run for the KISD School Board.

He's the type of person who needs to be on that Board. He would make all the

difference!

Imagine if you will, a school board composed of Fred Hink, Bill

Proctor, Cormac Creaven, Cynthia Blackman, Terri Majors, Kameron Searle, and Neal Howard!

Honest people all, of varying political persuasions but up front about what they believe,

well educated, and people who care about students, not themselves! Think how different our school

district would be!

Just a thought.

One thing's for sure. You won't be seeing controversies like this

any more. Controversial issues will be decided behind closed doors and voted on in a

"consent agenda" unanimously, and never see the light of day. That's what you voted

for yourselves when you got rid of Dr. Proctor.

Funny how these people can't see how aligned they are in actions,

beliefs, and behavior with Barrack Hussein Obama!

Can you even imagine that the school board read Mr. Creaven's letter

and then in a split 5-2 vote still voted for Linebarger over Perdue? Truly an amazing

testament to their stupidity.

CORMAC P. CREAVEN

ATTORNEY AT LAW

21107 CRYSTAL GREENS DRIVE

KATY, TEXAS 77450

October 14th, 2011

AltonFrailey@KATYISD.ORG

joeadams@KATYISD,ORG

henrydibrell@KATYISDORG

rebeccafox@KATYISD.ORG

NealHoward@KATYISD,ORG

robertshaw@KATYISD.ORG

BillProctor@KATYISD.ORG

TerryHuckaby@KATY1SD.ORG

Dear Superintendent and Board of Trustees:

The purpose of this letter is to provide you with

some background on the Linebarger, Goggan,

Blair & Sampson ("Linebarger") law firm. Once you

have read this letter and supporting

documentation I am confident you will make the

right decision with respect to which law firm is

best suited to represent Katy Independent School

District in the collection of delinquent taxes.

The additional background I am referring to is as

follows:

APRIL 2003

(See Attached Petition Case No. SA-03-CA-0269;

Gila Corporation v.

Linebarger Goggan Blair & Sampson; In the United

States District Court for the Western

District of Texas)

The Linebarger law firm is sued for violations of

the Racketeer Influenced and Corrupt

Organizations Act. The suit alleges a pattern of

racketeering activity that touches every major

city contract within the State of Texas. The case

was dismissed by agreement of the parties only

after a confidentiality order was put in

place. The settlement agreement and its terms,

including

the amount paid by Linebarger,

are to remain confidential with the exception of

disclosures

compelled or

required by law, court order, subpoena, or to a

party's financial advisers, financial

institutions,

accountants, and attorneys as necessary for the

rendition of professional or lending

services, or

financial disclosures necessary to comply with

bidding and contracting requirements

of clients or prospective clients of

the parties (Exhibit 1).

Katy ISD should demand disclosure of this

settlement agreement as part of its contracting

requirements.

SEPTEMBER 2004

On September 15th

2004, Juan Pena, formerly with the Linebarger law

firm, pleads guilty to

conspiracy to commit bribery and bank fraud. Pena

was found guilty of bribing two San Antonio

city council members in an attempt to wrestle a

San Antonio fine-collection contract away froanother

firm that was preferred by city staff. Pena was

sentenced to 30 months in federal prison

(Exhibit 2).

JAN 2005-

JAN 2009

Linebarger law firm fired by the City of Chicago

after it was revealed that Linebarger had

"bankrolled a vacation for city official who

oversaw its contract".

Class Action lawsuit filed in New Orleans against

Linebarger for excessive unauthorized

attorney fees totaling millions of dollars

collected by the firm.

I have omitted various incidents that occurred

during this period that involved Linebarger.

However if the district wishes to educate itself

with respect to this time period I suggest further

research of events that occurred in Chicago, New

Orleans and Philadelphia (Exhibit 3).

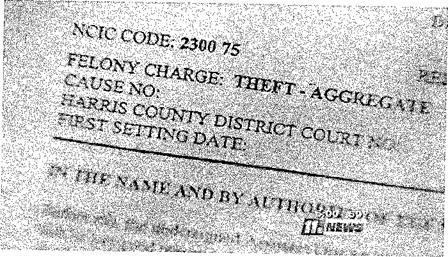

FEBRUARY 2010

Linebarger employee in the Houston office indicted

for stealing tax payer payments (Exhibit 4).

JUNE 2011

FBI investigation. Linebarger office manager in

Shelby County quits job after more than

$800,000.00 goes missing in tax payer refunds.

(Exhibit 5).

JULY 2011

FBI investigation. Commissioner Price in Dallas

investigated on corruption charges. Who's

who on the FBI warrant list in connection with the

corruption probe - a senior named partner at the

Linebarger law firm's Dallas office. (Exhibit 6).

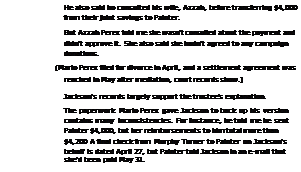

JULY 2011

Allegations of impropriety directly related to

recent Fort Worth School Board Elections. Over

$4,000.00

was "donated" by a partner in the Linebarger,

Goggan, Blair & Sampson law firm to

underwrite

Tobi Jackson's successful election campaign.

Incredibly, the size of this very generous

donation from the Linebarger partner went

unreported

for almost a year. It now appears the donation was

not a donation at all. In fact, Trustee Jackson

has filed a sworn affidavit stating she had no

knowledge of this "loan\donation". It was

subsequently revealed that Trustee Jackson neither

knew about nor consented to Mario Perez

("Linebarger partner") paying a Pennsylvania-based

company for calls made on behalf of the Jackson

Campaign. Trustee Jackson has filed an affidavit

verifying these facts! Clearly, this

unsolicited interference in a school board

election must be considered one of the most

egregious and alarming developments to date

(Exhibits 7 and 8).

It should also be noted that the Linebarger Law

firm "won" the Fort Worth ISD collection

contract immediately after the election. However

these recent events have caused the school

district to reconsider its decision and the

contract has been cancelled.

OVERALL COLLECTION RATES

During my address to the School Board a question

was raised by trustee Rebecca Fox with

respect to which firm would be best suited to

provide Katy ISD with the strongest possible

collection

rates. The answer to this question is clear and

unequivocal. Katy ISD tax collections

can only be

maximized by engaging a firm other than Linebarger.

This is due to the fact that

Linebarger has

a potential conflict when representing Katy

Independent School District in the

collection of

delinquent taxes. This conflict is created as

Linebarger has a duty "to serve too many masters"

located within the boundaries of Katy ISD. This

can best be demonstrated by

way of a

hypothetical example as follows:

Let's say that

delinquent taxpayer Smith lives in Kelliwood

Greens, Katy, Texas. Mr. Smith's

property falls

within the boundaries of Fort Bend County and Katy

Independent School District.

Currently, the

Linebarger law firm collects delinquent taxes for

both these taxing entities. If Mr.

Smith makes a

partial payment of say $1,000.00 toward the

outstanding delinquent amount, the

Linebarger law

firm would be compelled to divide that payment

between Fort Bend County and

Katy

Independent School District. This would naturally

result in Katy ISD receiving only a portion

of the $1,000.00 payment.

If on the other hand, a different law firm was

hired to collect delinquent taxes for Katy ISD the

result

would be very different. In the above example a

competing law firm would collect the

$1,000.00

payment on behalf of Katy ISD and no portion

of that payment would be provided to Fort

Bend County. A firm serving one master, Katy ISD,

would be in the best interests of the

district. This

is not possible with Linebarger since it currently

represents Harris, Waller and Fort

Bend

Counties, which comprises over 90% of Katy's tax

roll.

I anticipate Linebarger will respond by suggesting

that all delinquent taxes are prorated amongst

all taxing entities when collected. Such a

response would be disingenuous as proration of

taxes

amongst taxing entities only occurs after

litigation or the sale of a property. In Katy, as

in most

taxing jurisdictions, the vast majority of taxes

are collected prior to litigation. Therefore, any

taxing entity

that receives a payment for delinquent taxes prior

to litigation retains the total

amount

collected.

Linebarger may also argue that all firms collect

for multiple overlapping taxing jurisdictions.

For example the Purdue law firm collects for the

city of Katy. Again, such an argument would be

disingenuous as Linebarger has a duty to collect

for over 90% of all competing taxing entities in

the Katy area. Thus, any comparison of the law

firms based upon these facts would be a

complete

distortion that lacks creditability.

Finally, I would like to thank the administration

and board for their diligence in looking into this

matter and for all the excellent work you provide

for the district.

Cormac Creaven

INDEX OF ARTICLES

Exhibit 1.

Lawsuit alleging violations of the Racketeer

Influenced and Corrupt

Organizations Act (RICO) relating to contracts in

Houston, Austin, Dallas,

Corpus Christi and

other cities. Linebarger settled the lawsuit for

an undisclosed sum.

Exhibit 2.

Article relating to the bribery conviction of Juan

Pena of the Linebarger, Goggan,

Blair, Pena & Sampson law firm.

Exhibit 3.

Article relating to Linebarger, Goggan, Blair &

Sampson's conduct in Chicago,

New Orleans and Fort Worth and the subsequent

firing of the law firm.

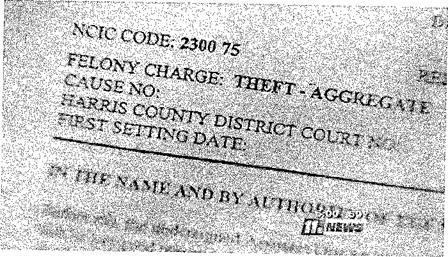

Exhibit 4.

Indictment of Linebarger employee ("Houston

office") for theft of tax payer

funds.

Exhibit 5.

FBI investigation in Shelby County concerning the

embezzlement of over

$800,000.00.

Exhibit 6

FBI investigation in Dallas corruption probe.

Exhibit 7

Fort Worth school board election.

Exhibit 8

Correction Affidavit filed by Tobi Jackson

attesting to have no knowledge of an

alleged loan from Linebarger partner Mario Perez.

\k

'03

\

\OC

\k

'03

\

\OC

, CP ..

IN THE UNITED STATES DISTRICT COURT

,R'k\\

-c-'\Jc

FOR THE WESTERN DISTRICT OF TEXAS

SAN

ANTONIO DIVISION

SAN

ANTONIO DIVISION

,14

16ILA

CORPORATION, d/b/a

MUNICIPAL

SERVICES BUREAU

MUNICIPAL

SERVICES BUREAU

§

CASE

NO. SA-03-CA-0269

LINEBARGER GOGGAN BLAIR &

SAMPSON, LLP, f/k/a LINEBARGER

§

GOGGAN BLAIR PENA & SAMPSON, §

LLP, and JUAN M. PENA

COMPLAINT

TO THE HONORABLE UNITED STATES DISTRICT COURT:

Gila Corporation, d/b/a Municipal Services Bureau

(MSB), plaintiff, pursuant

to Rule 15(a), Federal Rules of Civil Procedure,

submits its Complaint against

Linebarger Goggan Blair & Sampson, LLP, f/k/a

Linebarger Goggan Blair Pena &

Sampson, LLP (Linebarger), and Juan M. Pena

(Pena), defendants, as follows:

Introduction

1.

This is an action to recover actual, exemplary,

and statutory damages,

attorneys' fees, interest, and costs, for

defendants' violations of the Racketeer

Influenced and Corrupt Organizations Act (RICO),

18 U.S.C. §§ 1962(a), (c), & (d),

and 1964, for defendants' tortious interference

with MSB's contracts and

prospective contractual and business

relationships, and for defendants' unfair

competition and civil conspiracy to commit unfair

competition in violation of Texas

law. The suit was originally filed on February 26,

2003, in the 225th Judicial

1.

This is an action to recover actual, exemplary,

and statutory damages,

attorneys' fees, interest, and costs, for

defendants' violations of the Racketeer

Influenced and Corrupt Organizations Act (RICO),

18 U.S.C. §§ 1962(a), (c), & (d),

and 1964, for defendants' tortious interference

with MSB's contracts and

prospective contractual and business

relationships, and for defendants' unfair

competition and civil conspiracy to commit unfair

competition in violation of Texas

law. The suit was originally filed on February 26,

2003, in the 225th Judicial

District

Court, Bexar County, Texas, and was removed to

this Court by Lineberger

(joined by Pena) on April 4, 2003.

District

Court, Bexar County, Texas, and was removed to

this Court by Lineberger

(joined by Pena) on April 4, 2003.

2.

Pursuant to Rule 15(a), Federal Rules of Civil

Procedure, and prior to the

service by defendants of any responsive pleading,

MSB submits this Complaint

amending its state court pleading.'

Background

3.

Established in 1991, MSB collects delinquent fines

and fees for municipal,

county, and state courts throughout the country.

MSB is one of the largest

companies of its kind in the United States, and

represents more than 600

governmental entities nationwide.

4.

Lineberger is a law firm with offices in numerous

cities throughout Texas,

and in addition, Jacksonville, Florida; Memphis,

Tennessee; New Orleans, Louisiana;

Philadelphia, Pennsylvania; and Chicago, Illinois.

Its practice is devoted exclusively

to providing collection services to governmental

entities, including collection of

delinquent property taxes, student loans, and

federal debts, and beginning in about

1999, court fees and fines. At all relevant times

Pena was a name partner of and

principal in Lineberger.

5.

Generally, the procedure for awarding government

contracts for the

collection of court fines and fees involves the

following:

The

motions to dismiss for failure to state a claim

filed by each defendant on April 9,

2003, are not responsive pleadings within the

meaning of Rule 15(a).

Elliott v. Foufas,

867 F.2d

877, 882 (5th

Cir. 1989).

The

motions to dismiss for failure to state a claim

filed by each defendant on April 9,

2003, are not responsive pleadings within the

meaning of Rule 15(a).

Elliott v. Foufas,

867 F.2d

877, 882 (5th

Cir. 1989).

a.

the

governmental entity issues a request for proposal

(RFP) for collection

services;

the

governmental entity issues a request for proposal

(RFP) for collection

services;

b.

the proposals of qualified contractors are

evaluated and rated by

government staff; and

c.

the governing body awards a contract based upon

staff recommendations

and scores of the applicants.

6.

From its inception in 1991, until Lineberger began

seeking government

contracts for collection of court fines and fees,

MSB never lost a contract after

receiving the recommendation of government staff

or obtaining the highest score in

a formal evaluation. Since then, however, as more

fully discussed below, MSB has

lost numerous government contracts to Lineberger,

even after receiving the recommendation of

government staff, obtaining the highest score in

the formal evaluation, and in at least one case,

even after being awarded the contract.

7.

During

the 1999 Legislative Session, Lineberger drafted

and arranged

passage of legislation allowing a city or county

to add collection costs to the

amount of unpaid fines and fees for collection

services rendered by a law firm, but not for

services provided by a non-attorney firm such as

MSB. The legislation was

filed by two legislators who are friends and

associates of Pena. The effect of the

legislation would have been to put MSB out of

business; however, the bill was

ultimately vetoed by then Governor George W. Bush.

In his Official Memorandum

signed June 20, 1999, the Governor stated he was

vetoing the bill because it

"gives attorneys an unfair advantage over other

debt collection businesses."8.

During

the 1999 Legislative Session, Lineberger drafted

and arranged

passage of legislation allowing a city or county

to add collection costs to the

amount of unpaid fines and fees for collection

services rendered by a law firm, but not for

services provided by a non-attorney firm such as

MSB. The legislation was

filed by two legislators who are friends and

associates of Pena. The effect of the

legislation would have been to put MSB out of

business; however, the bill was

ultimately vetoed by then Governor George W. Bush.

In his Official Memorandum

signed June 20, 1999, the Governor stated he was

vetoing the bill because it

"gives attorneys an unfair advantage over other

debt collection businesses."8.

Notwithstanding

the Governor's veto in 1999, the same legislation

was

introduced by the same legislators on behalf of

Lineberger in the 2001 legislative

session, but collection firms successfully lobbied

lawmakers to amend the bill to

include non-attorney firms as well as lawyers.

Ultimately, the amended legislation

passed in the House on a 136-1 vote, and in the

Senate 30-0, and was signed into

law by Governor Rick Perry on June 15, 2001, but

not before a final, surreptitious

attempt by Lineberger in the waning hours of the

legislative session to change the

bill back to the language of the earlier bill

favoring attorneys only. After the second

of three readings in the House, the language of

the amended, non-discriminatory bill

was quietly, without discussion or debate, changed

back to the original language supported by

Lineberger which excluded non-lawyer collection

firms; however, this

last-minute furtive attempt by Linebarger to

eliminate its competition was

discovered and the agreed-upon language of the

amended bill was restored.

Notwithstanding

the Governor's veto in 1999, the same legislation

was

introduced by the same legislators on behalf of

Lineberger in the 2001 legislative

session, but collection firms successfully lobbied

lawmakers to amend the bill to

include non-attorney firms as well as lawyers.

Ultimately, the amended legislation

passed in the House on a 136-1 vote, and in the

Senate 30-0, and was signed into

law by Governor Rick Perry on June 15, 2001, but

not before a final, surreptitious

attempt by Lineberger in the waning hours of the

legislative session to change the

bill back to the language of the earlier bill

favoring attorneys only. After the second

of three readings in the House, the language of

the amended, non-discriminatory bill

was quietly, without discussion or debate, changed

back to the original language supported by

Lineberger which excluded non-lawyer collection

firms; however, this

last-minute furtive attempt by Linebarger to

eliminate its competition was

discovered and the agreed-upon language of the

amended bill was restored.

9.

On

or about October 9, 2002, Pefia, and H. Jack Pytel,

Jr. (Pytel), a San

Antonio lawyer who was retained as a lobbyist by

Linebarger, were indicted in the

United States District Court for the Western

District of Texas, San Antonio

Division, on five (5) counts of bribery and

conspiracy to commit bribery of two (2)

San Antonio City Council members, John Sanders

(Sanders) and Enrique "Kike"

Martin (Martin), in connection with Linebarger's

effort to obtain a contract from the

City of San Antonio for the collection of unpaid

municipal court fines and fees.10.

On

or about October 9, 2002, Pefia, and H. Jack Pytel,

Jr. (Pytel), a San

Antonio lawyer who was retained as a lobbyist by

Linebarger, were indicted in the

United States District Court for the Western

District of Texas, San Antonio

Division, on five (5) counts of bribery and

conspiracy to commit bribery of two (2)

San Antonio City Council members, John Sanders

(Sanders) and Enrique "Kike"

Martin (Martin), in connection with Linebarger's

effort to obtain a contract from the

City of San Antonio for the collection of unpaid

municipal court fines and fees.10.

The

arrest and indictment of Pena and Pytel, along

with Sanders and

Martin in October, 2002, and the resulting media

coverage of those events,

confirmed MSB's suspicions that its losses of

governmental contracts in San

Antonio and other municipalities and jurisdictions

throughout Texas and elsewhere,

were the result of a pattern of illegal and

tortious conduct on the part of the

defendants and others employed by or associated

with Lineberger.

The

arrest and indictment of Pena and Pytel, along

with Sanders and

Martin in October, 2002, and the resulting media

coverage of those events,

confirmed MSB's suspicions that its losses of

governmental contracts in San

Antonio and other municipalities and jurisdictions

throughout Texas and elsewhere,

were the result of a pattern of illegal and

tortious conduct on the part of the

defendants and others employed by or associated

with Lineberger.

Pattern of Racketeering Activity, Tortious

Interference, and Unfair Competition

The San Antonio Contract

11.

In 2001 the San Antonio City Council issued a RFP

for a four (4) year

contract to collect unpaid municipal court fines

and fees owed the City. Seven

firms submitted bids, including MSB and Linebarger.

12.

After

a lengthy review process City staff recommended

that council

award the contract to MSB because of MSB's

substantial experience in collecting

municipal court fines, and because MSB guaranteed

a higher collection rate and

thus more revenues to the City. The staff

calculated that MSB would collect $1.8

million more a year in delinquent fines than the

City had been collecting, and about

$600,000 more a year than the Lineberger firm had

promised. However, as more

fully discussed below, Pena, Pytel, Peter Estevez

(Estevez), who was also retained

by Lineberger as a lobbyist, and other principals,

employees, associates, and agents of Lineberger,

conspired to obtain the fines and fees contract

for Lineberger through

a pattern of racketeering activity; namely, by

bribing and offering gifts to members

After

a lengthy review process City staff recommended

that council

award the contract to MSB because of MSB's

substantial experience in collecting

municipal court fines, and because MSB guaranteed

a higher collection rate and

thus more revenues to the City. The staff

calculated that MSB would collect $1.8

million more a year in delinquent fines than the

City had been collecting, and about

$600,000 more a year than the Lineberger firm had

promised. However, as more

fully discussed below, Pena, Pytel, Peter Estevez

(Estevez), who was also retained

by Lineberger as a lobbyist, and other principals,

employees, associates, and agents of Lineberger,

conspired to obtain the fines and fees contract

for Lineberger through

a pattern of racketeering activity; namely, by

bribing and offering gifts to members

of

city council to support Linebarger's bid and

engaging in organized criminal

activity, in violation of Title 18, United States

Code, §§ 371 & 666(a)(1) and (2),

and Texas Penal Code, §§ 15.02, 36.02, 36.09,

34.02 and 71.02.

of

city council to support Linebarger's bid and

engaging in organized criminal

activity, in violation of Title 18, United States

Code, §§ 371 & 666(a)(1) and (2),

and Texas Penal Code, §§ 15.02, 36.02, 36.09,

34.02 and 71.02.

13.

On or about January 10, 2002, the city council

voted on the fines and

fees contract. The vote was 5 to 4, with five (5)

council members voting for

Linebarger's bid, and the Mayor and three (3)

council members (including Sanders)

voting in favor of MSB. Martin and another council

member abstained. Because

six (6) votes were needed to win the contract, no

award was made at that time.

14.

On or about January 11, 2002, Lineberger and Pena

hired Pytel and

Estevez to lobby city council members to vote for

the Linebarger bid at the next

city council vote on the matter.

15.

On or about February 1, 2002, Pena and Pytel met

with certain members

of the city council at the La Cantera golf course

in San Antonio to discuss the

Lineberger bid.

16.

On or about March 13, 2002, Pena delivered a check

in the amount of

$25,000 to Pytel intending that a portion of the

funds would be used to pay bribes

to San Antonio City Council members to obtain

their support of Linebarger's bid for

the fines and fees contract.

1

7. Pena agreed to pay Pytel an additional $25,000

to be used in furtherance

of the scheme to bribe San Antonio City Council

members to vote for Linebarger's

bid for the fines and fees contract and arranged a

loan to Pytel in that amount from

1

7. Pena agreed to pay Pytel an additional $25,000

to be used in furtherance

of the scheme to bribe San Antonio City Council

members to vote for Linebarger's

bid for the fines and fees contract and arranged a

loan to Pytel in that amount from

a

Rio Grande Valley bank of which Pefia served as a

director. Based on information

and belief, after Pytel signed a note to the bank

and received the funds, Lineberger

paid off the loan or provided funds for Pytel to

pay off the loan. The above

conduct constitutes money laundering in violation

of § 34.02 of the Texas Penal

Code. Based on information and belief, defendants

and their prinicipals, employees,

associates, and agents, have used similar methods

to fund and conceal bribes to

public officials to obtain other government

collection contracts.

a

Rio Grande Valley bank of which Pefia served as a

director. Based on information

and belief, after Pytel signed a note to the bank

and received the funds, Lineberger

paid off the loan or provided funds for Pytel to

pay off the loan. The above

conduct constitutes money laundering in violation

of § 34.02 of the Texas Penal

Code. Based on information and belief, defendants

and their prinicipals, employees,

associates, and agents, have used similar methods

to fund and conceal bribes to

public officials to obtain other government

collection contracts.

18.

On

or about March 14, 2002, Pena and Pytel gave

Martin $2,500 cash

in return for Martin's agreement to vote for the

Lineberger bid, in violation of Title

18, United States Code, § 666(a)(1)(B) & (2), and

Texas Penal Code, §§ 36.02,

36.09, and 71.02.

On

or about March 14, 2002, Pena and Pytel gave

Martin $2,500 cash

in return for Martin's agreement to vote for the

Lineberger bid, in violation of Title

18, United States Code, § 666(a)(1)(B) & (2), and

Texas Penal Code, §§ 36.02,

36.09, and 71.02.

19.

On or about March 14, 2002, Pytel and Martin

discussed paying a bribe

to Sanders in return for his vote for the

Lineberger bid.

20.

On or about April 1, 2002, Pefia, Pytel, and

Estevez paid Sanders

$2,500 cash in return for Sanders' agreement to

vote for the Linebarger bid, and

promised him an additional payment of $2,500 after

the vote on the fines and fees

contract, in violation of Title 18, United States

Code, §666(a)(1)(B) & (2), and

Texas Penal Code, §§ 36.02, 36.09, and 71.02.

21.

On or about April 8, 2002, Pefia and Pytel paid

Martin an additional

$5,000 cash in return for Martin's support of the

Lineberger bid, in violation of Title 18,

United States Code, §666(a)(1)(B) & (2), and Texas

Penal Code, §§ 36.02,

36.09, 34.02 and 71.02.

18,

United States Code, §666(a)(1)(B) & (2), and Texas

Penal Code, §§ 36.02,

36.09, 34.02 and 71.02.

22.

On or about April 18, 2002, city council

reconsidered the fines and fees

contract and awarded the contract to Linebarger on

a 7-3 vote. This time Martin

and Sanders voted in favor of the Linebarger bid,

giving Linebarger the necessary votes to win the

contract.

23.

On

or about May 1, 2002, Pena, Pytel, and Estevez

paid Sanders an

additional $2,000 cash as payment for his vote on

April 18, 2002, in favor of the

Linebarger bid on the fines and fees contract, in

violation of Title 18, United States

Code, §666(a)(1)(B) & (2), and Texas Penal Code,

§§ 36.02, 36.09, and 71.02.

On

or about May 1, 2002, Pena, Pytel, and Estevez

paid Sanders an

additional $2,000 cash as payment for his vote on

April 18, 2002, in favor of the

Linebarger bid on the fines and fees contract, in

violation of Title 18, United States

Code, §666(a)(1)(B) & (2), and Texas Penal Code,

§§ 36.02, 36.09, and 71.02.

24.

Linebarger

obtained the fines and fees contract as a

direct result of the

pattern of criminal conduct committed by

its principal, Pena, its agents and

associates, Pytel and Estevez, and other

principals, employees and associates of

Linebarger. But for the defendants' illegal

conduct, unfair competition, and tortious

interference, there was a reasonable probability

the fines and fees contract would

have been awarded to MSB as recommended by city

staff. In fact, on December

12, 2002, two months after the arrests and

indictment of Pena and Pytel were

announced, the city council terminated

Linebarger's contract and on January 30, 2003,

awarded a municipal court fines and fees

collection contract to MSB (the

"replacement contract").25.

As a direct and proximate result of defendants'

illegal conduct, unfair

competition, and tortious interference, MSB has

been damaged (a) in the amount of

the profits it lost during the time Linebarger

operated the contract and while

defendants' illegal conduct, unfair competition,

and tortious interference prevented

formation of a contract between MSB and the City,

and (b) in the reduced profit

opportunity available to MSB under the replacement

contract by reason of the

changed circumstances applicable to the

replacement contract. This sum is at least

$210,000 and consists of the difference between

the profits MSB would have

realized had it been awarded the fines and fees

contract at the time the City initially

considered the matter, and the profits it will

realize from the replacement contract.

The City of Dallas Contract

Linebarger

obtained the fines and fees contract as a

direct result of the

pattern of criminal conduct committed by

its principal, Pena, its agents and

associates, Pytel and Estevez, and other

principals, employees and associates of

Linebarger. But for the defendants' illegal

conduct, unfair competition, and tortious

interference, there was a reasonable probability

the fines and fees contract would

have been awarded to MSB as recommended by city

staff. In fact, on December

12, 2002, two months after the arrests and

indictment of Pena and Pytel were

announced, the city council terminated

Linebarger's contract and on January 30, 2003,

awarded a municipal court fines and fees

collection contract to MSB (the

"replacement contract").25.

As a direct and proximate result of defendants'

illegal conduct, unfair

competition, and tortious interference, MSB has

been damaged (a) in the amount of

the profits it lost during the time Linebarger

operated the contract and while

defendants' illegal conduct, unfair competition,

and tortious interference prevented

formation of a contract between MSB and the City,

and (b) in the reduced profit

opportunity available to MSB under the replacement

contract by reason of the

changed circumstances applicable to the

replacement contract. This sum is at least

$210,000 and consists of the difference between

the profits MSB would have

realized had it been awarded the fines and fees

contract at the time the City initially

considered the matter, and the profits it will

realize from the replacement contract.

The City of Dallas Contract

26.

In 1995, the City of Dallas issued a RFP for a

contract to collect unpaid

municipal court fines and fees. After a lengthy

formal review and evaluation

process conducted by city staff, MSB was awarded

the contract in June, 1998. In 2001, after the

primary term expired, the contract was extended

for an additional

one hundred eighty (180) day period.

27.

In 2002 city staff was instructed to prepare and

issue a Request for Bid

seeking bids on a new fines and fees collection

contract, instead of issuing another

RFP. Unlike a RFP, a bid process requires the City

to select the lowest qualified bidder without

regard to any other factors. Municipal court

personnel involved in

the administration of the contract were perplexed

by these instructions because

(1)

all previous collection contracts, including all

fines and fees collection contracts,

had been issued pursuant to RFPs, and not requests

for bids; and (2) city staff was

satisfied with MSB's performance of the fines and

fees contract. In fact, figures

provided by the City show that during the three

year term of the contract, MSB's

collection rate averaged approximately 10.3%,

which represented an increase of

almost 50% over the collection rate achieved by

the previous contractor

(approximately 10.3% v, approximately 7%).

(1)

all previous collection contracts, including all

fines and fees collection contracts,

had been issued pursuant to RFPs, and not requests

for bids; and (2) city staff was

satisfied with MSB's performance of the fines and

fees contract. In fact, figures

provided by the City show that during the three

year term of the contract, MSB's

collection rate averaged approximately 10.3%,

which represented an increase of

almost 50% over the collection rate achieved by

the previous contractor

(approximately 10.3% v, approximately 7%).

28.

The bid specifications issued by the City required

applicants to guarantee

a collection rate and provided for penalties of up

to 100% of the monthly fee (depending upon the

size of the deficiency) if the actual collection

rate fell below

the guaranteed rate. The specifications provided

for a six (6) month grace period in

which to attain the guaranteed rate, after which

time the penalty provisions would

become effective, and further gave the City the

right to cancel the contract after

four (4) consecutive months of failure to achieve

the guaranteed rate.

29.

Several

firms, including MSB and Lineberger, submitted

bids in response

to the Request for Bid. Lineberger submitted the

winning bid, which included a

16.5% guaranteed collection rate and a 30% fee,

and in or about February, 2002,

was awarded the contract.

Several

firms, including MSB and Lineberger, submitted

bids in response

to the Request for Bid. Lineberger submitted the

winning bid, which included a

16.5% guaranteed collection rate and a 30% fee,

and in or about February, 2002,

was awarded the contract.

30.

The winning bid submitted by Lineberger was not

viable because the

collection rate it guaranteed was unattainable,

and after the expiration of the grace

period,

would have inevitably resulted in the triggering

of the 100% penalty and

cancellation provisions specified in the bid

conditions.

period,

would have inevitably resulted in the triggering

of the 100% penalty and

cancellation provisions specified in the bid

conditions.

31.

MSB officials could not understand why the

Lineberger firm would

knowingly submit a bid for the Dallas fines and

fees contract that was not

economically viable. In December, 2002; however,

MSB learned that several

months after the contract was awarded to

Lineberger, and within the six (6) month

grace period, the Dallas City Council, in

violation of state contract procurement

statutes and regulations, allowed Lineberger to

amend the contract to eliminate the

guarantee and penalty provisions.

32.

In

an attempt to justify the proposed amendment of

Linebarger's

contract, the City Manager's office issued a memo

stating that the proposal to

eliminate the guarantee and penalty provisions in

Linebarger's contract would not

have an adverse financial impact on the City.

Based on information and belief, at

the time this memo was issued, city officials knew

that amending Linebarger's

contract to eliminate the guarantee and penalty

provisions would have an adverse

financial impact on the City, and that the City

Manager's representations to the

contrary were false. Moreover, Linebarger's

performance under the amended

contract shows that the City has and will continue

to suffer financially as a result

of the illegal amendment of Linebarger's contract.

The City will lose in excess of

$1,000,000 in gross revenues as a result of (1)

Linebarger's failure to perform

(Linebarger's collection rate is approximately 4%

versus MSB's collection rate of

In

an attempt to justify the proposed amendment of

Linebarger's

contract, the City Manager's office issued a memo

stating that the proposal to

eliminate the guarantee and penalty provisions in

Linebarger's contract would not

have an adverse financial impact on the City.

Based on information and belief, at

the time this memo was issued, city officials knew

that amending Linebarger's

contract to eliminate the guarantee and penalty

provisions would have an adverse

financial impact on the City, and that the City

Manager's representations to the

contrary were false. Moreover, Linebarger's

performance under the amended

contract shows that the City has and will continue

to suffer financially as a result

of the illegal amendment of Linebarger's contract.

The City will lose in excess of

$1,000,000 in gross revenues as a result of (1)

Linebarger's failure to perform

(Linebarger's collection rate is approximately 4%

versus MSB's collection rate of approximately

10.3% under the previous contract); (2)

Linebarger's fee, which is

approximately 50% higher than MSB's fee under the

previous contract (Linebarger

receives 30% of gross revenues collected versus

MSB's fee of 20.5% under the

previous contract); and (3) elimination of the

guarantee and penalty provisions set

out in the bid specifications and contract awarded

to Linebarger.

approximately

10.3% under the previous contract); (2)

Linebarger's fee, which is

approximately 50% higher than MSB's fee under the

previous contract (Linebarger

receives 30% of gross revenues collected versus

MSB's fee of 20.5% under the

previous contract); and (3) elimination of the

guarantee and penalty provisions set

out in the bid specifications and contract awarded

to Linebarger.

33.

Since the fines and fees contract was awarded to

Linebarger in or about

February, 2002, another collection-related

contract has been awarded by the City

of Dallas, pursuant to a RFP rather than a request

for bid. Thus, the fines and fees contract awarded

to Linebarger is the only instance, before or

since, of a collection

contract being awarded by the City pursuant to a

Request for Bid rather than a RFP.

34.

Based on information and belief, Linebarger,

through its principals,

employees, associates, and agents, conspired with

certain city officials to obtain

the fines and fees contract by submitting a bogus

and fraudulent bid with the understanding that

after being awarded the contract, it would be

allowed to amend

the contract to its advantage, and to the

disadvantage of the City, in violation of

state procurement statutes and regulations. This

understanding, which was

solicited and received by Linebarger, and which

was not made public or disclosed to

the other vendors bidding for the contract,

enabled Linebarger to rig the bidding

process, in violation of § 39.06 of the Texas

Penal Code and § 552.104 of the

Texas Government Code. Linebarger's illegal

conduct, as set forth above,

constitutes unfair competition and tortious

interference with MSB's contractual and

business

relationships with the City of Dallas. Based on

MSB's previous

performance collecting unpaid court fines and fees

for the City, and its excellent

working relationship with municipal court

administrators and staff, it is reasonably

probable that the fines and fees contract would

have been awarded to MSB, but for

Linebarger's illegal conduct, unfair competition,

and tortious interference.

business

relationships with the City of Dallas. Based on

MSB's previous

performance collecting unpaid court fines and fees

for the City, and its excellent

working relationship with municipal court

administrators and staff, it is reasonably

probable that the fines and fees contract would

have been awarded to MSB, but for

Linebarger's illegal conduct, unfair competition,

and tortious interference.

35.

As

a direct and proximate result of Linebarger's

illegal conduct, unfair competition, and tortious

interference, MSB has been damaged in the amount

of at

least $1,914,375, representing the profit MSB

would have realized had it been

awarded the fines and fees contract instead of

Linebarger.

As

a direct and proximate result of Linebarger's

illegal conduct, unfair competition, and tortious

interference, MSB has been damaged in the amount

of at

least $1,914,375, representing the profit MSB

would have realized had it been

awarded the fines and fees contract instead of

Linebarger.

The Dallas County Justice of the Peace Courts

Contract

36.

In March, 1997, pursuant to a formal RFP process,

Dallas County

awarded MSB a six (6) year contract (with renewal

provisions) to collect unpaid

court fines and fees (the "Dallas County

contract"). Initially, only the county courts

used MSB's services, but in 2000 MSB began

providing collection services for

several of the eight (8) justice of the peace

courts (JP courts) with the

understanding that it would eventually begin

collecting unpaid fines and fees for the

rest of the JP courts pursuant to the terms of the

Dallas County contract. In 2001,

however, Linebarger was awarded a contract to

collect the JP courts' unpaid fines

and fees (the "JP contract"), without issuance of

a RFP, request for bid or any

other formal review process.

37.

Lineberger,

through its principals, employees, associates, and

agents,

illegally rigged the process by soliciting and

receiving a private agreement from

county officials that it would be awarded the

contract without issuance of a RFP or

any other competitive bidding process, in

violation of § 39.06 of the Texas Penal

Code and § 552.104 of the Texas Government Code.

Based on information and

belief, MSB further alleges that Linebarger,

acting through its principals, employees,

associates, and agents, obtained the JP contract

by illegal means; namely, by

offering, conferring, or agreeing to confer

benefits on county officials as

consideration for awarding the contract to

Lineberger, in violation of Texas Penal

Code, §§ 36.02, 36.09, and 71.02. These acts were

willfully and intentionally

committed by Lineberger, its principals,

employees, associates, and agents, and

were calculated to and did cause damage to MSB in

its lawful business.

Lineberger,

through its principals, employees, associates, and

agents,

illegally rigged the process by soliciting and

receiving a private agreement from

county officials that it would be awarded the

contract without issuance of a RFP or

any other competitive bidding process, in

violation of § 39.06 of the Texas Penal

Code and § 552.104 of the Texas Government Code.

Based on information and

belief, MSB further alleges that Linebarger,

acting through its principals, employees,

associates, and agents, obtained the JP contract

by illegal means; namely, by

offering, conferring, or agreeing to confer

benefits on county officials as

consideration for awarding the contract to

Lineberger, in violation of Texas Penal

Code, §§ 36.02, 36.09, and 71.02. These acts were

willfully and intentionally

committed by Lineberger, its principals,

employees, associates, and agents, and

were calculated to and did cause damage to MSB in

its lawful business.

38.

Moreover,

Lineberger had actual knowledge of the existence

of the

Dallas County contract and that MSB was performing

collection services for county and JP courts

pursuant to that contract.

Moreover,

Lineberger had actual knowledge of the existence

of the

Dallas County contract and that MSB was performing

collection services for county and JP courts

pursuant to that contract.

39.

As a direct and proximate result of Linebarger's

illegal conduct, unfair

competition, and tortious interference with MSB's

contractual and business

relationships with Dallas County, MSB has been

damaged in the amount of at least

$225,000, representing the profit MSB would have

realized from performing

collection services for the JP courts during the

remaining term of the Dallas County

contract, but for Linebarger's tortious

interference.

The

Fort Worth Contract

The

Fort Worth Contract

40.

Historically, the City of Fort Worth has always

issued a RFP for collection

of its unpaid court fines and fees. During the

summer of 2002, MSB officials

learned that Linebarger was lobbying the City in

an effort to obtain the fines and

fees contract. Thomas Giamboi, the President of

MSB, met with Assistant City Manager Charles

Boswell, and requested an opportunity to submit a

proposal, but

was told by Mr. Boswell that the matter was

probably out of his hands.

Subsequently, other MSB officials met with several

city council members. At each

of these meetings, MSB simply requested an

opportunity to submit a proposal and

compete for the contract. One council member

suggested that MSB submit a written request and

that upon doing so, it would have an opportunity

to compete

for the contract. Eventually, however, city

officials stopped communicating with MSB and the

contract was awarded to Lineberger by city council

without giving

MSB or any other contractor an opportunity to

compete for the contract, and

without issuance of a RFP, request for bid or any

other formal review process.

41.

Lineberger,

through its principals, employees, associates, and

agents,

illegally rigged the process by soliciting and

receiving a private agreement from city

officials that it would be awarded the contract

without issuance of a RFP or any other competitive

bidding process, in violation of § 39.06 of the

Texas Penal Code and § 552.104 of the Texas

Government Code. Based on MSB's experience

collecting delinquent court fines and fees and its

stellar reputation, it is reasonably

Lineberger,

through its principals, employees, associates, and

agents,

illegally rigged the process by soliciting and

receiving a private agreement from city

officials that it would be awarded the contract

without issuance of a RFP or any other competitive

bidding process, in violation of § 39.06 of the

Texas Penal Code and § 552.104 of the Texas

Government Code. Based on MSB's experience

collecting delinquent court fines and fees and its

stellar reputation, it is reasonably

15

15

probable

that the contract would have been awarded to MSB,

but for Lineberger's

illegal conduct, unfair competition, and tortious

interference.

probable

that the contract would have been awarded to MSB,

but for Lineberger's

illegal conduct, unfair competition, and tortious

interference.

42.

As

a direct and proximate result of Linebarger's

illegal conduct, unfair

competition, and tortious interference to exclude

MSB from consideration by the

City, MSB has been damaged in the amount of at

least $315,000, representing the

profit MSB would have realized had it been awarded

the contract instead of

Lineberger.

As

a direct and proximate result of Linebarger's

illegal conduct, unfair

competition, and tortious interference to exclude

MSB from consideration by the

City, MSB has been damaged in the amount of at

least $315,000, representing the

profit MSB would have realized had it been awarded

the contract instead of

Lineberger.

The Houston Contract

43.

In 2000 the City of Houston issued a RFP for

collection of its unpaid

court fines and fees. The RFP included numerous

requirements which would have made it difficult,

if not impossible for a vendor to profitably

perform the contract.

These included (1) providing and staffing kiosks

at various locations throughout the

City; (2) creating and maintaining an electronic

interface available through the

internet that Internet users could access to make

payments and obtain information

about their cases; and (3) posting a performance

bond. At the pre-proposal

conference the court administrator emphasized that

these requirements were nonnegotiable.

As a result, MSB did not submit a proposal, and

based on information and belief Lineberger was the

only firm to respond to the RFP. Subsequently, the

City awarded Lineberger a contract that did not

include the requirements which the

City previously represented to MSB were

non-negotiable.

44.

Based on information and belief, MSB alleges that

Linebarger, acting

through its principals, employees, associates, and

agents, conspired with certain

city officials to obtain the contract without the

onerous and unacceptable

provisions by offering, conferring, or agreeing to

confer benefits on those officials

as consideration for awarding Linebarger the

contract, in violation of Texas Penal

Code, §§ 36.02, 36.09, and 71.02. In addition,

Lineberger rigged the bidding

process by soliciting and receiving a private

agreement from city officials that the

above requirements in the RFP would be waived for

Linebarger, in violation of

§39.06 of the Penal Code and § 552.104 of the

Texas Government Code.

45.

Linebarger's

actions constitute unfair competition and tortious

interference with MSB's prospective contractual

and business relationship with the

City of Houston. Based on MSB's experience

collecting delinquent court fines and

fees and its stellar reputation, it is reasonably

probable that the contract would

have been awarded to MSB, but for Linebarger's

tortious interference.

Linebarger's

actions constitute unfair competition and tortious

interference with MSB's prospective contractual

and business relationship with the

City of Houston. Based on MSB's experience

collecting delinquent court fines and

fees and its stellar reputation, it is reasonably

probable that the contract would

have been awarded to MSB, but for Linebarger's

tortious interference.

46.

As

a direct and proximate result of Linebarger's

unfair competition and

tortious interference with MSB's prospective

business relationship with the City,

MSB has been damaged in the amount of at least

$1,875,000, representing the

profit MSB would have realized had it been awarded

the fines and fees collection

contract instead of Linebarger.

As

a direct and proximate result of Linebarger's

unfair competition and

tortious interference with MSB's prospective

business relationship with the City,

MSB has been damaged in the amount of at least

$1,875,000, representing the

profit MSB would have realized had it been awarded

the fines and fees collection

contract instead of Linebarger.

The

Corpus Christi Contract

The

Corpus Christi Contract

47.

In

the fall of 2000, the City of Corpus Christi

issued a RFP for collection

of its unpaid municipal court fines and fees. An

evaluation committee was formed

by city staff and a formal process was established

by the court administrator to evaluate the

proposals submitted in response to the REP. Five

(5) firms responded

to the RFP, including MSB and Lineberger. The

evaluation committee ranked MSB

first and Lineberger second; however, the city

council overruled the committee and

on April 10, 2001, awarded the contract to

Lineberger. Perla represented

Lineberger before the city council. Linebarger's

original proposed fee was higher than MSB's, but

after the responses were submitted, Lineberger was

allowed to

amend its proposal and agreed to a fee .5% lower

than the fee proposed by MSB.

Based on information and belief, MSB alleges that

Lineberger and Pena received

from city officials information that had not been

made public about the amount of MSB's proposed

fee, that enabled Lineberger to rig the bidding

process, in violation

of § 39.06 of the Texas Penal Code and § 552.104

of the Texas Government Code. Shortly after the

contract was awarded to Linebarger, the court

administrator resigned and took a similar position

in another city.

In

the fall of 2000, the City of Corpus Christi

issued a RFP for collection

of its unpaid municipal court fines and fees. An

evaluation committee was formed

by city staff and a formal process was established

by the court administrator to evaluate the

proposals submitted in response to the REP. Five

(5) firms responded

to the RFP, including MSB and Lineberger. The

evaluation committee ranked MSB

first and Lineberger second; however, the city

council overruled the committee and

on April 10, 2001, awarded the contract to

Lineberger. Perla represented

Lineberger before the city council. Linebarger's

original proposed fee was higher than MSB's, but

after the responses were submitted, Lineberger was

allowed to

amend its proposal and agreed to a fee .5% lower

than the fee proposed by MSB.

Based on information and belief, MSB alleges that

Lineberger and Pena received

from city officials information that had not been

made public about the amount of MSB's proposed

fee, that enabled Lineberger to rig the bidding

process, in violation

of § 39.06 of the Texas Penal Code and § 552.104

of the Texas Government Code. Shortly after the

contract was awarded to Linebarger, the court

administrator resigned and took a similar position

in another city.

48.

Based

on information and belief, MSB further alleges

that Lineberger,

Pena, and other principals, employees, associates,

and agents of Lineberger,

conspired with certain city officials to obtain

the contract by illegal means and did

obtain the contract by illegal means; namely, by

offering, conferring, or agreeing to

Based

on information and belief, MSB further alleges

that Lineberger,

Pena, and other principals, employees, associates,

and agents of Lineberger,

conspired with certain city officials to obtain

the contract by illegal means and did

obtain the contract by illegal means; namely, by

offering, conferring, or agreeing to

confer benefits on city officials as consideration

for awarding the contract to

Lineberger, in violation of Texas Penal Code, §§

15.02, 36.02, 36.09, and 71.02.

Based on the results of the formal evaluation by

city staff, it is reasonably probable

that the contract would have been awarded to MSB,

but for the illegal conduct,

unfair competition, and tortious interference of

defendants and their principals, employees,

associates, and agents.

49.

As a direct and proximate result of Linebarger's

and Peria's illegal

conduct, unfair competition, and tortious

interference to prevent MSB from being

awarded the City contract, MSB has been damaged in

the amount of at least

$300,000, representing the profit MSB would have

realized had it been awarded

the contract instead of Lineberger.

The Beaumont Contract

50.

MSB

was twice awarded four (4) year contracts by the

City of Beaumont

to collect its unpaid court fines and fees

pursuant to a formal RFP process. The

first contract covered the period from about May

1, 1993, through about August 1,

1997, and the term of the second contract was from

on or about August 1, 1997,

through on or about August 31, 2001. During this

eight (8) year period MSB

developed an excellent working relationship with

city staff, and city employees

regularly expressed satisfaction with MSB's

performance under the contract. On or

about August 28, 2001, however, MSB received a

letter from the City stating that there were no

plans to issue another RFP or "rebid the

contract." The letter gave

MSB

was twice awarded four (4) year contracts by the

City of Beaumont

to collect its unpaid court fines and fees

pursuant to a formal RFP process. The

first contract covered the period from about May

1, 1993, through about August 1,

1997, and the term of the second contract was from

on or about August 1, 1997,

through on or about August 31, 2001. During this

eight (8) year period MSB

developed an excellent working relationship with

city staff, and city employees

regularly expressed satisfaction with MSB's

performance under the contract. On or

about August 28, 2001, however, MSB received a

letter from the City stating that there were no

plans to issue another RFP or "rebid the

contract." The letter gave

no explanation for the City's decision not to

issue another RFP. Shortly thereafter, the City

entered into a contract with Lineberger without

issuance of a RFP or any other formal review

process.

51.

Lineberger,

through its principals, employees, associates, and

agents,

illegally rigged the process by soliciting and

receiving a private agreement from city

officials that it would be awarded the contract

without issuance of a RFP or any

other competitive bidding process, in violation of

§ 39.06 of the Texas Penal Code

and § 552.104 of the Texas Government Code. Based

on information and belief,

MSB further alleges that Lineberger, acting

through its principals, employees,

associates, and agents, obtained the fines and

fees contract by illegal means;

namely, by offering, conferring, or agreeing to

confer benefits on city officials as

consideration for awarding the contract to

Lineberger, in violation of Texas Penal

Code, §§ 36.02, 36.09, and 71.02. Based on MSB's

previous performance

collecting unpaid court fines and fees for the

City and its excellent working

relationship with city staff, it is reasonably

probable that the fines and fees contract

would have been awarded to MSB, but for

Lineberger's illegal conduct, unfair competition,

and tortious interference.

Lineberger,

through its principals, employees, associates, and

agents,

illegally rigged the process by soliciting and

receiving a private agreement from city

officials that it would be awarded the contract

without issuance of a RFP or any

other competitive bidding process, in violation of

§ 39.06 of the Texas Penal Code

and § 552.104 of the Texas Government Code. Based

on information and belief,

MSB further alleges that Lineberger, acting

through its principals, employees,

associates, and agents, obtained the fines and

fees contract by illegal means;

namely, by offering, conferring, or agreeing to

confer benefits on city officials as

consideration for awarding the contract to

Lineberger, in violation of Texas Penal

Code, §§ 36.02, 36.09, and 71.02. Based on MSB's

previous performance

collecting unpaid court fines and fees for the

City and its excellent working

relationship with city staff, it is reasonably

probable that the fines and fees contract

would have been awarded to MSB, but for

Lineberger's illegal conduct, unfair competition,

and tortious interference.

52.

As

a direct and proximate result of Linebarger's

illegal conduct, unfair

competition, and tortious interference with MSB's

contractual and business

relationships with the City, MSB has been damaged

in the amount of at least

As

a direct and proximate result of Linebarger's

illegal conduct, unfair

competition, and tortious interference with MSB's

contractual and business

relationships with the City, MSB has been damaged

in the amount of at least

$76,056,

representing the profit MSB would have realized

had it been awarded the fines and fees contract

instead of Lineberger.

$76,056,

representing the profit MSB would have realized

had it been awarded the fines and fees contract

instead of Lineberger.

The Port Arthur Contract

53.

On

or about August 3, 1993, MSB and the City of Port

Arthur entered

into a contract for the collection of the City's

unpaid court fines and fees. The

contract provided for automatic annual renewals

unless one of the parties took

affirmative action to terminate the contract. MSB

performed collection services for the City

pursuant to this contract for eight (8) years,

until on or about August 31,

2001. At that time MSB and the City entered into a

new contract effective

September 1, 2001, which changed MSB's fee

arrangement. The new contract

contained the same automatic annual renewal

provision as the previous contract. During this

eight (8) year period, and continuing under the

new contract in 2002,

MSB had an excellent working relationship with

city staff and city employees

regularly expressed satisfaction with MSB's

performance under the contract. In the

spring of 2002, however, the City verbally

terminated the contract without explanation, and

almost immediately thereafter entered into a fines

and fees

contract with Lineberger.

On

or about August 3, 1993, MSB and the City of Port

Arthur entered

into a contract for the collection of the City's

unpaid court fines and fees. The

contract provided for automatic annual renewals

unless one of the parties took

affirmative action to terminate the contract. MSB

performed collection services for the City

pursuant to this contract for eight (8) years,

until on or about August 31,

2001. At that time MSB and the City entered into a

new contract effective

September 1, 2001, which changed MSB's fee

arrangement. The new contract

contained the same automatic annual renewal

provision as the previous contract. During this

eight (8) year period, and continuing under the

new contract in 2002,

MSB had an excellent working relationship with

city staff and city employees

regularly expressed satisfaction with MSB's

performance under the contract. In the

spring of 2002, however, the City verbally

terminated the contract without explanation, and

almost immediately thereafter entered into a fines

and fees

contract with Lineberger.

54.

Based

on information and belief, MSB alleges that

Lineberger, acting

through its principals, employees, associates, and

agents, obtained the fines and

fees contract by illegal means; namely, by

offering, conferring, or agreeing to

confer benefits on city officials as consideration

for terminating the contract with

Based

on information and belief, MSB alleges that

Lineberger, acting

through its principals, employees, associates, and

agents, obtained the fines and

fees contract by illegal means; namely, by

offering, conferring, or agreeing to

confer benefits on city officials as consideration

for terminating the contract with

MSB and awarding a contract to Lineberger, in

violation of Texas Penal Code,

§ §36.02, 36.09, and 71.02. These acts were

willfully and intentionally committed

by Linebarger, its principals, employees,

associates, and agents, and were

calculated to and did cause damage to MSB in its

lawful business.

55.

Moreover,

at all relevant times, Linebarger had actual

knowledge of the

existence of MSB's contract with the City.

Moreover,

at all relevant times, Linebarger had actual

knowledge of the

existence of MSB's contract with the City.

56.

As a direct and proximate result of Linebarger's

illegal conduct, unfair

competition, and tortious interference with MSB's

contractual and business

relationships with the City, MSB has been damaged

in the amount of at least

$43,755, representing the profit MSB would have

realized from performing

collection services under the contract, but for

Linebarger's illegal conduct, tortious

interference, and unfair competition.

The Miami-Dade County, Florida Contract

57.

In the fall of 1999, Miami-Dade County (County)

issued a Request for Qualifications seeking

proposals for the collection of its unpaid court

fines and fees

and announced it would select up to five (5)

vendors. Eleven firms submitted

proposals, including MSB and Lineberger. An

evaluation committee was formed to

review the proposals and rate the firms in various

categories. A New York

company received the highest overall score and

MSB and another firm tied for the

second highest score. Lineberger finished fourth.

In November, 2000, the County

selected three firms to collect delinquent fines

and fees: the New York firm that received

the highest rating from the evaluation committee,

the company that tied

for second place with MSB, and Linebarger, despite

the fact that MSB scored

higher in the evaluation process and proposed a

lower fee for services than

Lineberger.

received

the highest rating from the evaluation committee,

the company that tied

for second place with MSB, and Linebarger, despite

the fact that MSB scored

higher in the evaluation process and proposed a

lower fee for services than

Lineberger.

58.

Based

on information and belief, MSB alleges that

Lineberger, acting

through its principals, employees, associates, and

agents, obtained the fines and

fees contract by illegal means; namely, by

corruptly giving, offering, or promising to

give pecuniary or other benefits not authorized by

law to County officials in return

for selecting lower-ranked Lineberger as one of

the three contractors instead of

higher-ranked MSB, in violation of §§ 838.015 and

838.016 of the Florida

Annotated Statutes. Based on the results of the

County's formal evaluation, it is

reasonably probable that the contract would have

been awarded to MSB, but for

Linebarger's tortious interference.

Based

on information and belief, MSB alleges that

Lineberger, acting

through its principals, employees, associates, and

agents, obtained the fines and

fees contract by illegal means; namely, by

corruptly giving, offering, or promising to

give pecuniary or other benefits not authorized by

law to County officials in return

for selecting lower-ranked Lineberger as one of

the three contractors instead of

higher-ranked MSB, in violation of §§ 838.015 and

838.016 of the Florida

Annotated Statutes. Based on the results of the

County's formal evaluation, it is

reasonably probable that the contract would have

been awarded to MSB, but for

Linebarger's tortious interference.

59.

As a direct and proximate result of Linebarger's

illegal conduct, unfair

competition, and tortious interference to prevent

MSB from being awarded the

County contract, MSB has been damaged in the

amount of at least

$1

35,000,

representing the profit MSB would have realized

had it been awarded the contract

instead of Lineberger.

The Missouri City, Texas Contract

60.

In or about 2001 the firm that had been providing

collection services to

Missouri City went out of business. City staff

began negotiating contract term with

MSB and was prepared to recommend that city

council award MSB a contract

to collect the City's unpaid court fines and fees,

After a city council member who is an attorney

advocated awarding the contract to Lineberger,

proposals were

solicited and the city council awarded Linebarger

the contract.

with

MSB and was prepared to recommend that city

council award MSB a contract

to collect the City's unpaid court fines and fees,

After a city council member who is an attorney

advocated awarding the contract to Lineberger,

proposals were

solicited and the city council awarded Linebarger

the contract.

61.

Based on information and belief, MSB alleges that

Lineberger, acting

through its principals, employees, associates, and

agents, obtained the fines and

fees contract by illegal means; namely, by

offering, conferring, or agreeing to

confer benefits on city officials as consideration

for awarding the contract to

Lineberger, in violation of Texas Penal Code, §§

36.02, 36.09, and 71.02. Based

on MSB's experience collecting delinquent court

fines and fees, its stellar

reputation, and the contract negotiations

initiated with city staff, it is reasonably

probable that the contract would have been awarded

to MSB, but for Linebarger's

tortious interference, and unfair competition.

62.

As

a direct and proximate result of Linebarger's

illegal conduct, unfair

competition, and tortious interference to prevent

MSB from being awarded the city

contract, MSB has been damaged in the amount of at

least $45,000, representing

the profit MSB would have realized had it been

awarded the contract instead of

Lineberger.

As

a direct and proximate result of Linebarger's

illegal conduct, unfair

competition, and tortious interference to prevent

MSB from being awarded the city

contract, MSB has been damaged in the amount of at

least $45,000, representing

the profit MSB would have realized had it been

awarded the contract instead of

Lineberger.

Illegal use of racketeering proceeds invested in

the enterprise

63.

Historically, the largest and most lucrative part

of Linebarger's collection

business for governmental entities has consisted

of the collection of delinquent

taxes.

64.

Over

the years, Linebarger and Pefia, their principals,

employees,

associates, and agents, have engaged in a pattern

of racketeering activity to obtain

and maintain government contracts to collect

taxes; namely, by bribing and

conferring benefits on public officials, in return

for their votes and support, in

violation of Title 18, United States Code, §

666(a)(1)(B) & (2), and state criminal

laws including Texas Penal Code, §§ 36.02, 36.09,

and 71.02. Typically, these

bribes consist of cash payments and other benefits

given to public officials, such as

trips to Las Vegas and other destinations; hunting

trips to private ranches where

public officials are furnished food, drink, and

entertainment of their choosing; and

substantial payments characterized as campaign

contributions. In addition, to curry

favor with public officials who have control or

influence over the award of tax

collection contracts, Linebarger has refrained

from prosecuting claims against public